Today in this article as an experts with us will be the full-stack developer of the company “IT Fox” Nikita.

Today in this article as an experts with us will be the full-stack developer of the company “IT Fox” Nikita.

Launching your own startup is an exciting and expensive task.

One can only imagine how many promising projects have failed as soon as it comes to understanding the cost of production. However, getting funds for your project is quite realistic.

“According to a “Venture Barometer” analysis by Inc.

-89% of investors surveyed have invested in young projects: with one-third funding 10 or more young companies.

-77% of investors increased their investments in 2021, and 41% intend to increase them in 2022.”

Let’s imagine that the world would never have seen Google and SpaceX if the people we all know today hadn’t vetted their projects for viability. The history of most popular brands began as a simple experiment. Without serious investment, any project can remain just an idea.

“By the way, in 2021, the volume of venture capital investment worldwide reached a record $621 billion, more than double the figure of one year ago at $294 billion, according to analysts CB Insights on January 12, 2022. Slightly less than half of global investment in startups was in the U.S. market. According to Atomico, the total amount of venture capital funding in Europe is close to the level of Asia, where as of September 2021, the amount of venture capital investment was $110 billion, compared to $87 billion in 2020.”

Especially for those who want to know what to do to realize their business dream, we decided to write an article on how to attract investment in the project.

Where to Look for a Sponsor for a Startup?

Before we get to this part of the article, let’s discuss the most common source of funding – a loan from a bank. It is considered the safest way to finance a business.

Bank Credit

Even in this case it is good to have some start-up capital, so that the bank has a guarantee of your solvency.

What are the loans for business

In short, the purpose of use can be divided into three types of loans:

-To close cash gaps

-To replenish working capital

-To replenish fixed capital.

Determine the purpose, and then, as usual, leave an application on the bank’s website, a specialist will contact you and tell you what documents you need to prepare.

All banks have different requirements and restrictions, the main thing is to choose the most convenient variant.

Investment Companies, Venture Capital Funds, and Business Angels

You have probably heard more than once about investment companies and venture capital funds, and now we will look at how they differ from each other.

Venture Funds

These are funds which invest assets in companies or projects at the initial stage of their creation. Usually such funds are not engaged in portfolio investments, but in strategic investments in controlling blocks of shares and shares in limited liability companies. Incidentally, not every venture fund investment is successful. It is believed that 70-80% of investments give a loss. But the remaining 20-30% are so profitable that they more than cover the costs.

Each fund has certain criteria for making decisions. Everyone has different requirements to documents. The stage of development of the startup and the amount of investment play an important role in making the decision.

Each foundation has certain criteria for making decisions. Everyone has different requirements for documents. The stage of development of the startup and the amount of investment play an important role in the decision.

Business Angels

These are private venture capitalists who provide financial and expert support for the business, they are even able to attract the first customers.

Unlike venture capital funds, angels can enter a project even at the idea stage, and they also invest their own money.

It is clear from this that the amount of capital of a business angel is noticeably smaller than that of a venture fund, which attracts and actively accumulates funds from investors.

And while venture capital funds give preference to projects that can already somehow show financial efficiency, a business angel can simply invest in a project he is interested in.

Investment Company

We will call it IC. This is a company that provides private and corporate investors with a wide range of financial services and is an intermediary in the financial market.

ICs work on the same principle – they issue their own securities (shares) and raise funds from investors. The investment companies invest the collected finances in securities of various corporations. In other words, ICs actually finance different spheres of economy.

There are special ratings of ICs, where you can choose the safest organization.

Crowdinvesting

Familiar means of financing we have disassembled, and now move on to the most original and least known.

Along with the growing popularity of investing in projects, new options are emerging.

Today, it is not even necessary to leave home to find the right connections. There are online platforms or information clubs on the Internet, where you can not only find information about how to do business, but also get to know an investor directly.

Investments clubs exist not only on websites, but also in social networking groups and in thematic chats.

Crowdinvesting is another way to find an investor, even a group of investors who are willing to invest in your startup. The number of investors in this financing option is quite large.

The nuance is as follows: in exchange for their investment, the investor receives a share in your project or company. The risk level of such an investment is high.

The reason for the popularity of crowdfunding is that it is used by companies that have no financial history and cannot come to the bank for a loan.

In order to interest a crowdinvesting investor, you need to prepare a presentation of your idea and specify the amount of money you need. In addition, specify the investors’ remuneration and the frequency of payments. By the way, you will receive money not immediately, but only after reaching the target amount, because the crowding platform will need to pay a commission.

Crowdfunding

Crowdfunding platforms are another way to find an investor. It differs from crowdinvesting in that these platforms raise funds for different needs. Whereas crowdfunding is a narrower concept related specifically to investing, it also works on a special platform.

So, crowdfunding is the collective cooperation of people who voluntarily pool their money or other resources to support a person or organization in implementing an idea. For such fundraisers, the platform must declare a goal, determine the amount needed, calculate all costs, and information on the progress of fundraising is open to all. There are many proven platforms freely available to help people find funds for their goals every day.

Online Platforms for Investors

In addition to the platforms described above, there are also private platforms that organize fundraisers and attract investors.

This can be a website with a huge database of people and venture capitalists. Such services can help not only to find investors, but also help to attract new people to your project.

Some platforms have their own ranking of startups and allow investors to evaluate all the available projects.

There are such platforms that can show you all the successful deals made between investors and startup founders.

And with the help of others, you can even properly “package” your project and make it interesting for an investor. We advise you to take a closer look at such platforms, there you can get a lot of useful information for your startup.

We have prepared a list of such platforms for you, you can download it here:

https://docs.google.com/spreadsheets/d/1La1t5Zmzunn9_ByaLpxJ_hluY2aRLVVy14vPUfEdvzA/edit#gid=0

And a list of helpful resources here:

https://docs.google.com/spreadsheets/d/1skmykpeuW0MrDhXcVQILWen_YtkvWkjyB1EDeeO9DHA/edit?usp=sharing

Since there are so many startups and it’s not easy to stand out among them, there is another solution that will help you in moving towards your goal.

Paid advertising

A familiar way to get a customer’s attention these days is through paid advertising.

You can order it from opinion leaders in your niche, as well as use banner ads on the sites above.

You can also raise your visibility by taking paid promotion from them to stand out from the rest.

The main thing to take care of is to create a landing page or other concise and catchy page for your project.

But still, to really get an investor interested, not in words, but in deeds, it is best to make an MVP of your startup. Below we tell you what it is and how it is useful for those who want to increase their chances of getting an investment.

Create a Minimum Viable Product

MVP – Minimum Viable Product – a starting version of your future product, which allows you to collect maximum practical data on the interaction of the user with the product at minimum cost.

To help an investor understand how realistic and promising your startup is and what benefits it may bring, ideally you should create the MVP of your project.

If you only tell investors about the idea, your presentation will look less convincing, unrealistic, and maybe even infantile.

So before you start looking for investments, we recommend you to study the concept of MVP, and then test the demand for the product and see if the market needs it. At this stage, you can get not only the approval of potential customers, but also the first payments or preliminary contracts.

So before you start looking for investments, we recommend you to study the concept of MVP, and then test the demand for the product and see if the market needs it. At this stage, you can get not only the approval of potential customers, but also the first payments or preliminary contracts.

MVP applies to the creation of any product, but it is most often used in IT.

Comments from the Full-stack developer Nikita.

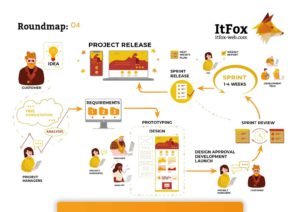

“In our company the process of MVP development takes place in several stages:

- identifying the target audience. Often the audience which the client considers as target, in fact, is not. At this stage you analyze the customers of the product, and draw a portrait of the client.

- Identification of the user’s needs. After studying the behavioral characteristics of the potential consumer, it becomes clear why he/she uses the product, and what problems he/she solves with it.

- analysis of competitors. It is necessary to study the competitors to work on uniqueness, to offer something original and to make the product better than others. At this stage there is an analysis of all direct and indirect competitors.

- SWOT analysis. This stage is an analysis of the external and internal environment, the strengths and weaknesses of the project, as well as opportunities and threats.

- Customer Path Analysis is the step where the sequence of steps the user takes when interacting with the product is examined. The project team goes through all of the user’s steps to identify points where the user needs help or more information.

- Definition of the main functions of the future product. After the analysis of the customer journey has been done, it becomes clear what the user lacks and how the product functionality can be supplemented. Thus, the product becomes minimally viable.

- Then one of the methodologies of project development is preferred: Lean, Scrum, Kanban.

- Product testing. At this stage, alpha and beta testing is done. All this is necessary to improve the product and eliminate technical problems.

The new product is tested by internal testers, members of the project team themselves, developers, and product owners. Next, you can let real customers try out the service. After that, collect feedback, make improvements and test again.New product is tested by internal testers, themselves members of the project team, developers and product owners. Then we give the service to real customers to try out. After that we collect feedback, make corrections and test it again”.

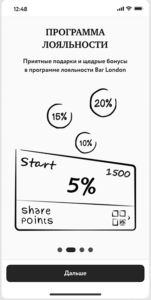

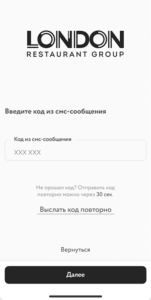

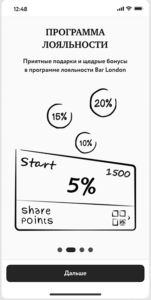

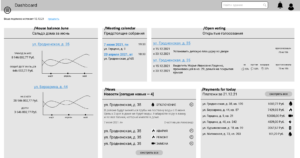

Here is an example of the functionality of MVP application for London Group:

Here you can see such functionality as:

-Authorization, user registration via SMS

-User Profile

-User roles (guest and waiter)

-User Survey Functionality

-Partnership Program functionalities

-Functionality of the unique invitation codes generated for each user for access to premium services

-Waiter interface with QR-code scanning functionality for receiving premium privileges

-Administrator’s panel with a list of users, time of visit, receipts, results of surveys, data on the loyalty program.

So, a huge layer of work is done for you. Now you know who will be interested in your product, how to improve it, plus you have worked out the customer’s path, which the investor will pass through as well.

You are confident in yourself, as you have tested the relevance of your own idea, fine-tuned the nuances and decided on the methodology of development.

The result:

The presentation of your startup is prepared at its best.

On what terms to work with investors

After your mvp has made a proper impression. It’s time to think about the main thing. How to build a partnership with the investor. This is a question everyone who attracts investments asks, and below we will tell you how investor and startup interaction happens.

Loan

90% of investors give startups a loan.

The standard scheme used by the majority:

Fixed interest (15 to 35% APR)

Monthly payments (from one month to one year)

The body of the debt at the end of the term (from 1 to 5 years).

This option is optimal, because the body of the capital in full is in the business, and during the term of the contract it can be rolled over an unlimited number of times. It is worth paying attention to the fact that the interest rate on the loan should be more favorable than that of the bank, otherwise the meaning of interaction with the investor is lost.

Without collateral under the personal guarantee

The second option is also quite common. In fact – it’s a guarantee. The owner or manager of the company gives a personal commitment to the investor to fulfill his part of the financial arrangements, and all this is recorded legally.

What’s the nuance? Guarantors are liable for company obligations with all their property, including future profits.

Surety issues are regulated by articles 361-367 of the Civil Code of the Russian Federation. Additional clarification can be found in the Resolution of the Plenum of the Supreme Commercial Court No. 42 of July 12, 2012 “On certain issues of dispute resolution related to surety”. Banks often require a surety not only from the CEO but also from the owners or even family members of the CEO and founders. In this case, the guarantor will have to be jointly or subsidiarily liable for the loan debts, even if there is no longer any connection between him and the borrower.

Business share

This option assumes that the starter gives the investor a share of the project. The size of the share must be calculated on the basis of the potential profitability. It should be at least 50% per annum, i.e. the investor should return his money in 2 years or sooner. It is also possible for an investor to receive a higher percentage before returning his investment, and after the percentage decreases. For example, at first 40%, and after the return of the investment – 20%.

It is best to enter into a partnership with an investor, giving up to 49% interest. Ideally, invest part of the project with your own money to be the main owner of the business. Share in the business is formalized by the creation of LLC (hereinafter – the company) with the corresponding shares of the founders, or an investment agreement.

And most importantly:

if you have chosen the option of a share in the business, do not assume the obligation to return the money. Protect yourself and talk to a competent lawyer.

How to formalize an agreement with an investor?

Only companies can formalize their relations with the investor. A sole proprietorship can conclude an oral transaction with an investor, disputes over which will be complicated for both parties in the future.

In Russian law, the term “investment agreement” refers to different ways of making investments in a business.

The most common are:

– participation in the authorized capital

– loan

– convertible loan

– purchase and sale of treasury share

– financing under a partnership agreement.

Let’s break down each item in more detail and make a step-by-step plan of how to execute each of them:

Participation in the Authorized Capital

This method is quite simple. The main thing is to observe the nuances: for example, be sure to draw up a protocol of the general meeting.

A step by step process:

– The investor writes an application for admission to the company and making investments. Such an application does not need to be notarized. In the application the investor indicates the size of his share in the authorized capital, which he wants to acquire, the size and composition of the contribution (money, property, property rights), the schedule of planned contributions.

– The participants hold a general meeting. For the decision to be taken, it must be unanimous. At the end of the meeting, minutes must be drawn up and notarized. In the minutes indicate: the amount of the share capital after the increase, the amount and composition of the investor’s contribution, the order of contribution, the amount of the share acquired by the investor and its nominal value, as well as the new amount of shares of all participants.

– Contribution by the investor. The period for making the contribution is no longer than six months from the date of the decision of the general meeting.

– Additional contributions by third parties are recorded on the basis of applications. Depending on the region this protocol can also be certified by a notary.

– The General Director of the company must sign an application for state registration of the changes made to the articles of association of the company. Contribution in full is confirmed by the participants in the application.

– Within a month after making a contribution to the company’s settlement account the state registration of the changes takes place. The procedure is considered to be completed from the moment the entry is made in the Unified State Register of Legal Entities.

Loan

How to process. The process is not complicated, here are the main points to consider:

1. The investor and the company conclude a loan agreement. The contract specifies the amount that goes to the company, and the type of loan – target or investment.

2. The amount and procedure of interest payments, terms of repayment and transfer of the loan are specified.

3. After signing the contract, the investor transfers money to the settlement account specified in the contract.

Convertible loan

How to execute. The process is described below:

-Discuss with the investor the terms of the future deal: the parameters of the loan, and possibly future conversion. Then draft the following documents: a) Decision of the general meeting of participants of the company on consent to conclude the convertible loan agreement b)The convertible loan agreement.

-After confirmation of all the nuances the investor submits an application for admission to the company and an application for making a contribution, which should include: the maximum amount of the investor’s contribution; information on the fact that on account of making a contribution the investor’s monetary claims to the company on obligations from the convertible loan agreement will be set off; the maximum amount of the investor’s share in the company’s charter capital after its increase.

-At the general meeting of the participants the decision to agree to the conclusion of the convertible loan agreement and the increase of the company’s charter capital on the basis of the investor’s application shall be unanimously adopted. The minutes of the meeting shall be notarized. It is important to take into consideration: if the requirement of obtaining consent is not observed the contract may not be recognized.

-A convertible loan agreement is concluded. Here it is necessary to specify the terms and circumstances, upon occurrence of which the investor has the right to present a demand to increase the charter capital of the company; the amount or procedure of determining the nominal value of the share, which the investor will receive in case of conversion of the loan, the amount of the contribution to be made.

-The contract is further certified by a notary.

-The notary within two days submits an application to the Unified State Register of Legal Entities with information on the convertible loan agreement.

Purchase and Sale of Treasury Share

How to draw up a contract. The stages of the transaction, which you need to pay attention to:

– Clarify whether the statute allows for the disposition of a treasury share to a third party.

– Determine the price. It must not be lower than the face value, if it was paid by the participant who left, or not lower than the price for which it was bought out by the company. It is possible to set another price, for this purpose it is necessary to make a unanimous decision at the general meeting.

– The conditions of distribution of corporate control are defined in details. The degree of influence on decision-making within the company is determined due to the fact that there is a new participant in the company. It is fixed in the agreement on the exercise of participants’ rights or in the charter of the company.

– Tax consequences are taken into consideration. By selling a share, the company receives income in the form of its redemption value. This means that profit tax will have to be paid on the difference between the cost of acquiring a share and its sale.

Financing under a partnership agreement

How to execute. The process is described below:

1. You conclude an agreement on the joint activities of the parties.

2. In the contract you must prescribe the term of the general partnership, the names of the parties, the duties of each partner in the general partnership.

3. separately in the contract it is important to spell out the amount, type and timing of contributions of the parties.

4. Choosing a partner to be in charge of general affairs.

5. You make contributions in the way prescribed in the contract. For example, in money to a checking account.

Every year, all countries issue regulations which support initiatives of technological start-ups.

For example, in Russia, according to the January 27, 2022 meeting on the implementation and results of initiatives for socio-economic development until 2030, one of the key initiatives was to support technological startups at all stages of their development – up to the launch of innovative production and attracting major investors.

In the U.S., universities play a special role in the development of entrepreneurial culture: almost every university supports student startup projects and, through partnerships with local foundations, opens doors to big business for them.

Chile offers $40,000 in free grants and $145M in grants and loans.

Israel is offering $450M in seed funding and R&D Engineer/Researcher projects, which focuses on research and development of innovative products, technologies and processes.

Friends, we hope that in this article you learned not only where to look for an investor and on what terms to cooperate with him, but also think about other important points. To start a great business, you need to be well prepared for it.

We wish you good luck and invite you to discuss the details of your mvp.

“Success depends entirely on preparation. Without it, you will inevitably fail.”

“Success depends entirely on preparation. Without it, you will inevitably fail.”

Confucius, Thinker and Philosopher of Ancient China

If you have any questions, we are happy to answer them!

Stages of mobile application development

Stages of mobile application development

The prototype

The prototype

Today in this article as an experts with us will be the full-stack developer of the company “IT Fox” Nikita.

Today in this article as an experts with us will be the full-stack developer of the company “IT Fox” Nikita. So before you start looking for investments, we recommend you to study the concept of MVP, and then test the demand for the product and see if the market needs it. At this stage, you can get not only the approval of potential customers, but also the first payments or preliminary contracts.

So before you start looking for investments, we recommend you to study the concept of MVP, and then test the demand for the product and see if the market needs it. At this stage, you can get not only the approval of potential customers, but also the first payments or preliminary contracts.